Your How much is vat tax if we top up free images are available in this site. How much is vat tax if we top up free are a topic that is being searched for and liked by netizens today. You can Find and Download the How much is vat tax if we top up free files here. Find and Download all royalty-free photos and vectors.

If you’re looking for how much is vat tax if we top up free images information connected with to the how much is vat tax if we top up free interest, you have visit the ideal blog. Our site frequently provides you with suggestions for seeking the maximum quality video and picture content, please kindly hunt and find more enlightening video articles and graphics that match your interests.

How Much Is Vat Tax If We Top Up Free. From June 1 2016 Krishi Kalyan Cess of 05 will also be added to this making the total service tax from June 1 onwards 15. The current standard rate of VAT is 23. How to pay VAT between the US. If you want to know how much VAT is in the amount you calculate the gross amount 120 net amount 020.

The resulting number will now exclude VAT. For example the UK VAT rate is 20 which means you would do pricefigure X 12 3. In general retail sales tax rates are lower than VAT rates 4-10 percent as opposed to 14-25 percent. If you want to know how much VAT is in the amount you calculate the gross amount 120 net amount 020. Businesses would simply raise prices to compensate. How to add VAT To calculate the current 20 rate of VAT on any number that excludes VAT simply multiply it by 12 and the result will then be inc VAT.

The rate of VAT in Germany is 19 with a limited number of goods being eligible for a lower 7 rate.

But how do you calculate that refund. Goods imported to Germany from outside the EU are subject to a different tax called Import Turnover Tax equal to 19 of the value of the items plus other import costs such as shipping. If you get Tax-Free Childcare youll set up an online childcare account for your child. The resulting number will now exclude VAT. Tax-free shopping can be a great way to save on your shopping abroad. Raw wool including animal hair.

Source: goforma.com

Source: goforma.com

Businesses would simply raise prices to compensate. You calculate 20 VAT by calculating the net amount x 120 then you have the gross amount. Sales tax and VAT are similar in that rates are often expressed as a percentage of the price. Many governments charge high VAT rates of 125 or 14-15. From June 1 2016 Krishi Kalyan Cess of 05 will also be added to this making the total service tax from June 1 onwards 15.

Source: pinterest.com

Source: pinterest.com

You calculate 20 VAT by calculating the net amount x 120 then you have the gross amount. Such goods are taxed at 12 13 or even 15 in different states. The standard rate was reduced to 21 from 1 September 2020 to 28 February 2021. The rate of VAT in Germany is 19 with a limited number of goods being eligible for a lower 7 rate. For every 8 you pay into this account the government will pay in 2 to use to pay your provider.

Source: frenchbusinessadvice.com

Source: frenchbusinessadvice.com

If something is exempt from VAT it is usually because the product is considered to be an essential. All other goods of local importance not notified by states as tax free goods. Others are exempt from VAT or outside the system altogether. You calculate 20 VAT by calculating the net amount x 120 then you have the gross amount. What we will try to summarize is how much the Free Fire Top Up costs 16000 Rupiah if we top up using credit.

Source: frenchbusinessadvice.com

Source: frenchbusinessadvice.com

You calculate 20 VAT by calculating the net amount x 120 then you have the gross amount. All other goods of local importance not notified by states as tax free goods. VAT exemption for goods and services. Contrary to popular belief VAT does not tax businesses more in order to reduce the tax burden on the end consumer. The standard rate was reduced to 21 from 1 September 2020 to 28 February 2021.

Source: pinterest.com

Source: pinterest.com

You calculate 20 VAT by calculating the net amount x 120 then you have the gross amount. That can add up to a lot of money and might even help you decide if youre going to buy an item or not. Entertainment duty stamps Passenger and goods tax stamp standard watermarked petition paper philatelic stamp Postal stationery and refund adjustment order. If you want to know how much VAT is in the amount you calculate the gross amount 120 net amount 020. In general retail sales tax rates are lower than VAT rates 4-10 percent as opposed to 14-25 percent.

Source: uscib.org

Source: uscib.org

VAT Percentage 2. If We Top Up Free Fire 16000 100 Diamond. Raw wool including animal hair. From June 1 2016 Krishi Kalyan Cess of 05 will also be added to this making the total service tax from June 1 onwards 15. What we will try to summarize is how much the Free Fire Top Up costs 16000 Rupiah if we top up using credit.

Source: frenchbusinessadvice.com

Source: frenchbusinessadvice.com

You calculate 20 VAT by calculating the net amount x 120 then you have the gross amount. Some goods and services are subject to VAT at a reduced rate of 5 such as domestic fuel or 0 such as most food and childrens clothing. Now you go to the supermarket and buy fruit. Businesses would simply raise prices to compensate. The resulting number will now exclude VAT.

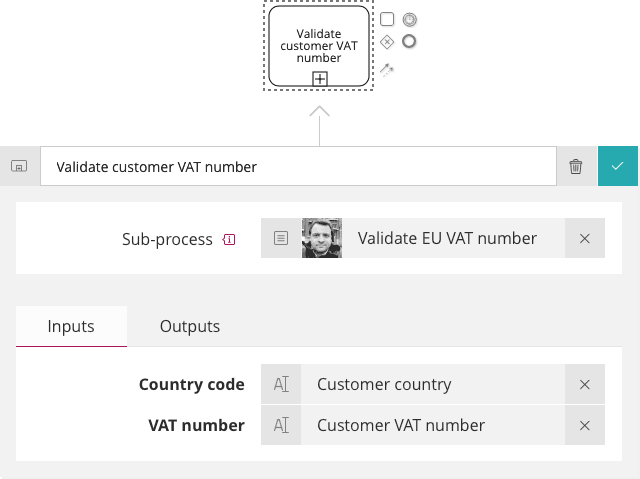

Source: signavio.com

Source: signavio.com

Many governments charge high VAT rates of 125 or 14-15. What we will try to summarize is how much the Free Fire Top Up costs 16000 Rupiah if we top up using credit. That can add up to a lot of money and might even help you decide if youre going to buy an item or not. The rate of service tax is 14 and along with Swachh Bharat Cess of 05 the amount charged to us is 145. Entertainment duty stamps Passenger and goods tax stamp standard watermarked petition paper philatelic stamp Postal stationery and refund adjustment order.

Source: hellotax.com

Source: hellotax.com

If you want to know how much VAT is in the amount you calculate the gross amount 120 net amount 020. In general retail sales tax rates are lower than VAT rates 4-10 percent as opposed to 14-25 percent. Also many state governments follow a general rate of VAT for goods which cannot be categorized to suit the above classification. Businesses would simply raise prices to compensate. The VAT increased from 175 to 20 on 4 January 2011.

Source: lexisnexis.co.uk

Source: lexisnexis.co.uk

Standard VAT rate 20 The standard VAT tax applies to all sales transactions of goods or services that are not part of the other levels. If you want to know how much VAT is in the amount you calculate the gross amount 120 net amount 020. The standard rate was reduced to 21 from 1 September 2020 to 28 February 2021. Contrary to popular belief VAT does not tax businesses more in order to reduce the tax burden on the end consumer. Others are exempt from VAT or outside the system altogether.

Source: pinterest.com

Source: pinterest.com

Also many state governments follow a general rate of VAT for goods which cannot be categorized to suit the above classification. You calculate 20 VAT by calculating the net amount x 120 then you have the gross amount. How to pay VAT between the US. Contrary to popular belief VAT does not tax businesses more in order to reduce the tax burden on the end consumer. If something is exempt from VAT it is usually because the product is considered to be an essential.

Businesses would simply raise prices to compensate. The standard rate was reduced to 21 from 1 September 2020 to 28 February 2021. Many governments charge high VAT rates of 125 or 14-15. The resulting number will now exclude VAT. If something is exempt from VAT it is usually because the product is considered to be an essential.

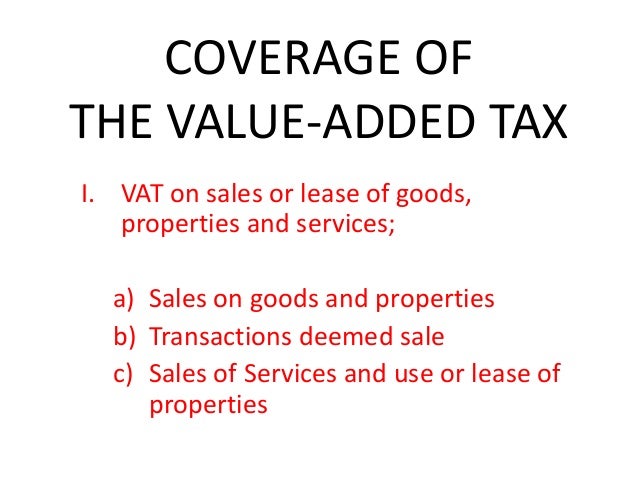

Source: slideshare.net

Source: slideshare.net

Entertainment duty stamps Passenger and goods tax stamp standard watermarked petition paper philatelic stamp Postal stationery and refund adjustment order. Others are exempt from VAT or outside the system altogether. The resulting number will now exclude VAT. For this test the pulse we are using is Axis yes again each operator might be different in terms of SC for VAT value added tax maybe the same. For example the UK VAT rate is 20 which means you would do pricefigure X 12 3.

Source: stripe.com

Source: stripe.com

X12Inc VAT How to subtractreverse VAT To subtractreverse the current 20 rate of VAT from any number that includes VAT divide it by 12. The resulting number will now exclude VAT. Others are exempt from VAT or outside the system altogether. Value Added Tax in different states across India. How to add VAT To calculate the current 20 rate of VAT on any number that excludes VAT simply multiply it by 12 and the result will then be inc VAT.

Source: wwkn.de

Source: wwkn.de

The rate of service tax is 14 and along with Swachh Bharat Cess of 05 the amount charged to us is 145. Although most goods and services are taxed at 20 VAT some products are taxed at a reduced VAT rate or are exempt from VAT altogether. If We Top Up Free Fire 16000 100 Diamond. The result is the VAT included. All other goods of local importance not notified by states as tax free goods.

Source: en.selectra.info

Source: en.selectra.info

Many governments charge high VAT rates of 125 or 14-15. Raw wool including animal hair. Diamond Price VAT 10 SC2 16000 VAT 1600 SC 320 Total. The resulting number will now exclude VAT. The rate of VAT in Germany is 19 with a limited number of goods being eligible for a lower 7 rate.

Source: in.pinterest.com

Source: in.pinterest.com

The VAT increased from 175 to 20 on 4 January 2011. Also many state governments follow a general rate of VAT for goods which cannot be categorized to suit the above classification. Raw wool 5 Animal hair 0. Value Added Tax in different states across India. Goods imported to Germany from outside the EU are subject to a different tax called Import Turnover Tax equal to 19 of the value of the items plus other import costs such as shipping.

Source: pinterest.com

Source: pinterest.com

Some goods and services are subject to VAT at a reduced rate of 5 such as domestic fuel or 0 such as most food and childrens clothing. All other goods of local importance not notified by states as tax free goods. Raw wool 5 Animal hair 0. The result is the VAT included. For example the UK VAT rate is 20 which means you would do pricefigure X 12 3.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title how much is vat tax if we top up free by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.